Government Supports are Responsible for Poverty Reductions

The poverty rate has fallen by nearly half since 1967, largely due to the growing effectiveness of economic security programs such as Social Security, food assistance, and tax credits for working families, according to a comprehensive poverty measure known as the anchored Supplemental Poverty Measure (SPM). Unlike the official poverty measure, the SPM counts the value of tax credits and non-cash benefits such as food assistance and rent subsidies (among other methodological differences), as most analysts favor.

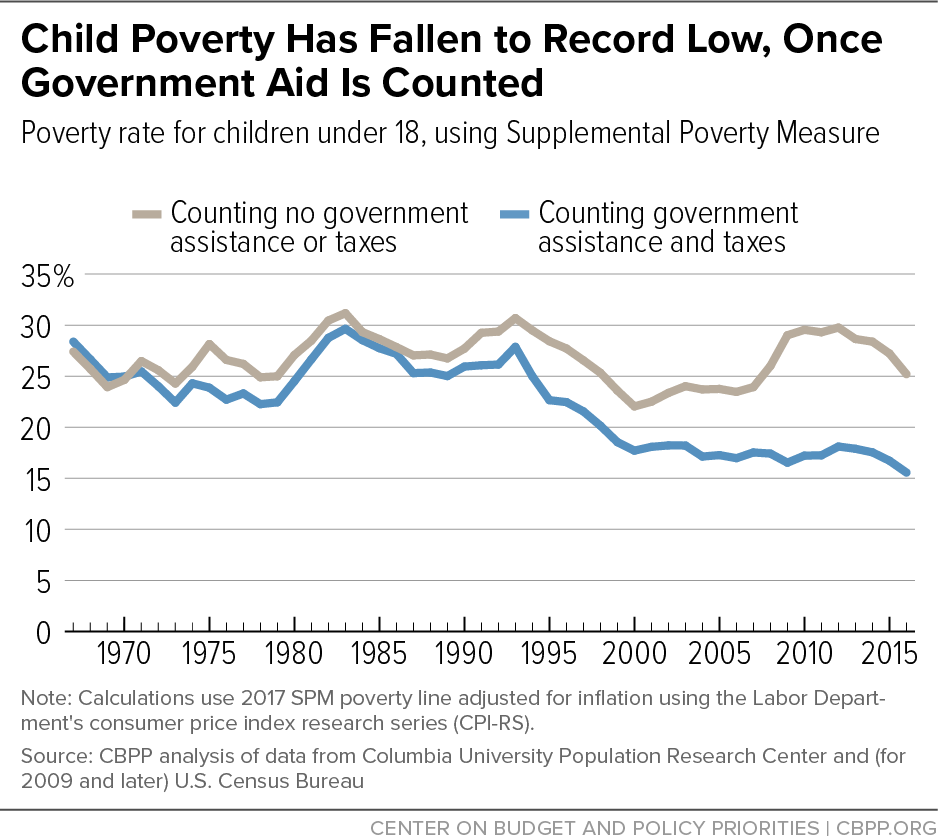

The SPM poverty rate in 2017 was 13.9 percent, statistically tied with the record low of 14.1 percent in 2000. That’s down from 25.1 percent in 1967, the first available year. The greater anti-poverty impact of economic security programs accounts for most of that improvement. Before taking government benefits and tax policies into account, poverty has improved little over the past five decades, falling only from 26.5 percent to 25.0 percent between 1967 and 2017.

Although the economy has grown considerably since 1967, earnings and other non-government income haven’t improved enough at the bottom to reduce poverty substantially; the poverty reduction has come primarily from stronger supports for struggling families.

In 1967, economic security programs lifted above the poverty line just 5 percent of those who would otherwise be poor; by 2017, that figure had jumped to 44 percent. These programs lifted 36 million people out of poverty in 2017, including nearly 7 million children.

Child poverty has also fallen substantially since 1967 when measured with the SPM. Under the measure, the child poverty rate remained at a record low of 15.6 percent in 2017, statistically tied with 2016’s record low — and a little more than half its 1967 level of 28.6 percent. When poverty is measured without counting the income that government programs provide, child poverty is only modestly lower than it was in the 1960s, though it has fallen significantly in the last few years as the labor market tightened.

These findings emerge from our analysis of data from the Census Bureau and historical SPM data produced by the Center on Poverty and Social Policy at Columbia University. We use the Census Bureau’s SPM data for 2009 through 2017 and the Columbia SPM data for prior years. We create an “anchored” series by using the 2017 SPM poverty line and adjusting it backwards for inflation. In 2017, the SPM threshold for a two-adult, two-child family renting in an average-cost community was $27,005.

Striking as these figures are, they understate economic security programs’ effectiveness. If we correct for the underreporting of major benefits in survey data, the SPM poverty rate in 2016 would have been 1.4 percentage points lower.

Poverty reduction programs benefit various racial and ethnic groups. Economic security programs lifted 6.7 million children above the SPM poverty line in 2017. That included 2.1 million white, 2.3 million Latino, and 1.6 million Black children.

Large differences in poverty by racial and ethnic groups remain, however. In 2017, economic security programs reduced poverty among white children from 15.1 percent to 9.5 percent, among Black children from 40.6 percent to 24.4 percent, and among Latino children from 35.4 percent to 23.2 percent.

Refundable tax credits and SNAP (formerly food stamps) account for much of the progress against child poverty over recent decades. In 1967, child poverty actually was modestly higher after taking government benefits and taxes into account, because the federal tax code taxed a substantial number of families with children into poverty.

Since then, federal policymakers have established and expanded the Earned Income Tax Credit (EITC) and Child Tax Credit, which now lift 4.8 million children above the poverty line. Nationwide implementation of SNAP in the 1970s and its increased effectiveness in reaching more eligible people have lifted millions of additional children out of poverty. Some 7 million more children would have been poor in 2017 if the anti-poverty effectiveness of economic security programs had remained at their 1967 level.

This progress is particularly important considering the long-lasting consequences of reducing child poverty. Research suggests that various economic security programs not only help families address their basic needs today, but they also can have longer-term positive effects on children, improving their health and helping them do better (and go farther) in school, thereby boosting their expected earnings as adults.

These poverty improvements should not obscure the real problems that remain, including the uneven distribution of income gains in recent decades. Further, our nation continues to lag well behind other similarly wealthy countries in addressing child poverty, in substantial part because government assistance is considerably weaker here.

Child poverty could be cut in half through a policy package that included a child allowance, raising the EITC, and help paying for child care, a recent National Academies of Sciences committee found. Policymakers looking to make further progress against child poverty should build on the strong anti-poverty effectiveness of programs such as SNAP and refundable tax credits.

Danilo Trisi is Senior Research Analyst in the Family Income Support Division at the Center on Budget and Policy Priorities.