Expand the EITC to Stop Taxing Childless Adults into Poverty

Working childless adults are the lone group in America that the federal tax code taxes into poverty—or even deeper into poverty. One reason is that they’re largely excluded from the pro-work benefits of the Earned Income Tax Credit (EITC). Fortunately, leading policymakers from both parties – including President Obama and House Speaker Paul Ryan – have proposed EITC reforms to address this urgent need. Improving the EITC for these workers is the most achievable anti-poverty accomplishment this year.

Federal income tax parameters like the standard deduction, personal exemption, and working-family tax credits (the EITC and Child Tax Credit) generally aim to ensure that federal income and payroll taxes don’t tax people further into poverty. For example, working-poor families with children can qualify for an EITC and Child Tax Credit that together offset their substantial payroll taxes and supplement their earnings.

Low-wage childless adults (and non-custodial parents) face a very different situation. Their EITC is just a small fraction of the EITC for workers with children, and they’re ineligible for the credit if they’re under 25. The federal tax code taxed more than 8 million of them into or deeper into poverty in 2014.

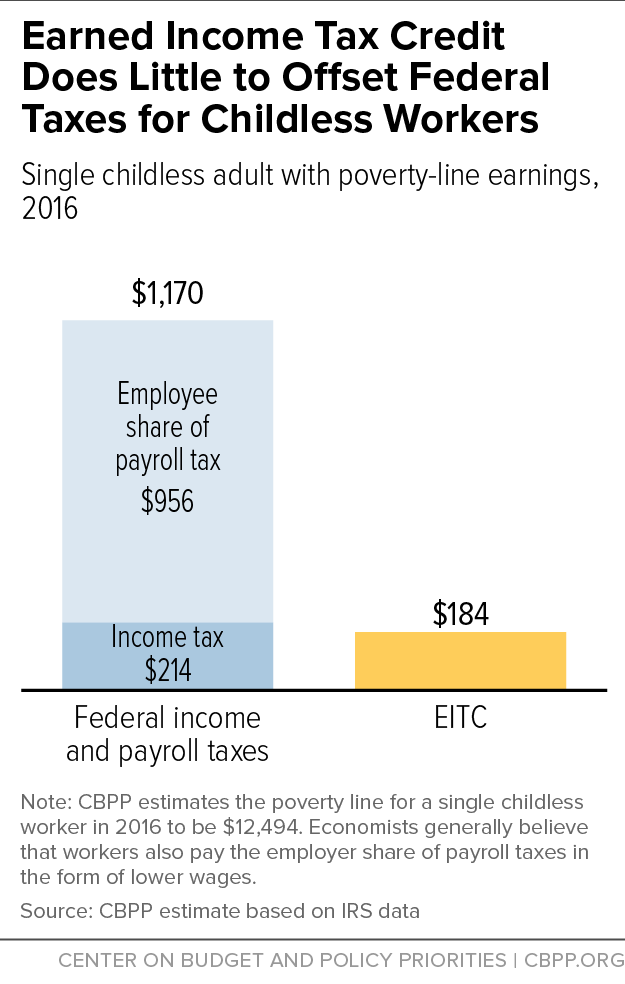

Consider a 21-year-old man just entering the labor market and making poverty-level wages (about $12,500 in 2016) on a construction site. He has $956 in payroll taxes deducted from his paycheck and pays $214 in federal income taxes. Because he receives zero EITC, he’s taxed into poverty.

Or consider a 30-year-old woman making poverty-level wages in a retail store. She owes the same taxes and receives only a tiny ($184) EITC, so she, too, is taxed into poverty. (See first chart.)

The EITC is designed to encourage and reward work and it does that very well, particularly for families with children. Rigorous research shows that it helps convince many people to get a job, making it a quintessential welfare reform measure. In fact, one highly regarded study found that EITC expansions in the 1990s did more to increase employment among single mothers than the 1996 welfare law.

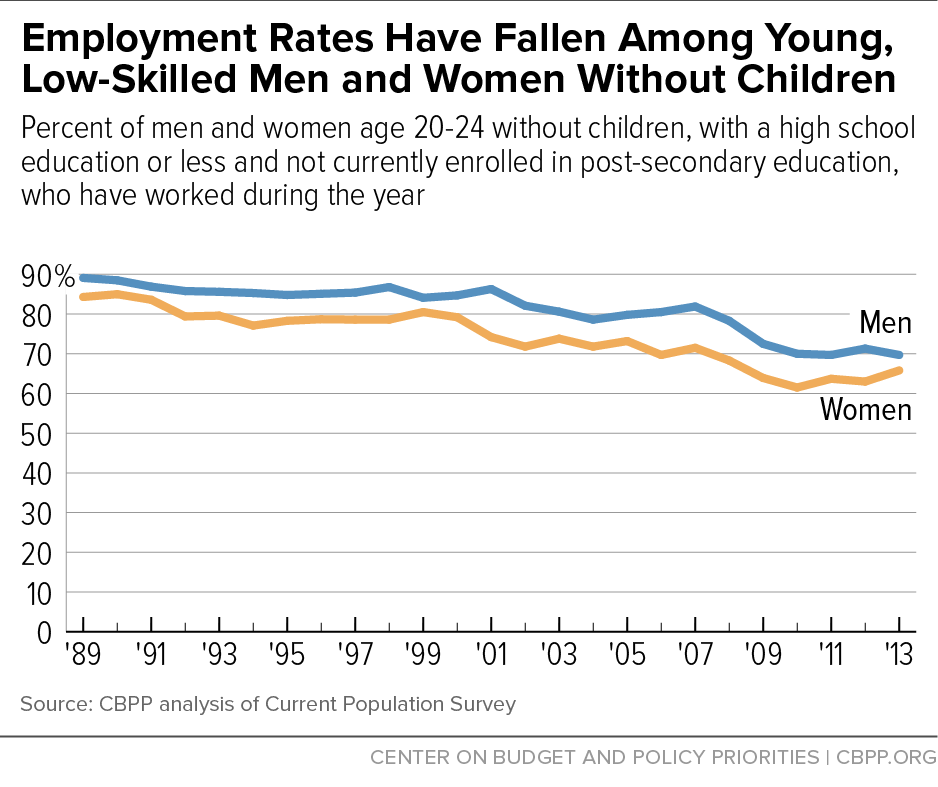

But this proven, pro-work success story excludes the group that arguably needs it most. As the second chart shows, labor force participation has significantly declined among less-educated young adults without children.

If policymakers were designing the EITC from scratch today, this group would likely be among the first to receive a robust EITC. Instead, the credit misses them entirely, and childless adults over 25 qualify for a small EITC at best.

President Obama, Speaker Ryan (R-WI), and Senator Sherrod Brown (D-OH) and Rep. Richard Neal (D-MA) have advanced specific proposals to fix this glaring hole in the EITC for childless adults. They share several common elements:

- Lower the eligibility age from 25 to 21.

- Double the credit’s phase-in rate, from 7.65 cents per dollar of increased earnings to 15.3 cents.

- Boost the maximum EITC for this group.

Under the Obama and Ryan proposals, the construction worker and retail salesperson mentioned above would receive an EITC of $868 in 2016 on their poverty-level wages. Under the more robust Brown proposal, their EITC would be $1,226.

The Brown proposal ensures that federal taxes would no longer tax childless adults into or deeper into poverty: its new, more robust EITC would fully offset a childless adult’s federal income taxes and the employee share of the payroll tax. While it wouldn’t offset regressive state and local taxes, it would constitute a major anti-poverty accomplishment. The Obama and Ryan proposals would be an important step towards this accomplishment.

The Obama and Ryan proposals would lift about half a million people out of poverty and make another 10.1 million people less poor, the Treasury Department estimates. The Brown proposal would have an even bigger anti-poverty effect.

Providing a more adequate EITC to low-income childless workers could have other benefits as well. Some leading experts believe that an expanded credit, by encouraging and rewarding work, would help address some of the challenges that less-educated young people (particularly young African-American men) face, including low and falling labor-force participation rates, low marriage rates, and high incarceration rates.

Americans across the political spectrum should agree that no one should be taxed into poverty, and leaders of both parties have advanced proposals to help address this unfair anomaly. This is an opportunity well worth seizing in 2016.

Chuck Marr is the director of federal tax policy at the Center on Budget and Policy Priorities.

To print a PDF version of this document, click here.

The views expressed in this commentary are those of the author or authors alone, and not those of Spotlight. Spotlight is a non-partisan initiative, and Spotlight’s commentary section includes diverse perspectives on poverty. If you have a question about a commentary, please don’t hesitate to contact us at commentary@spotlightonpoverty.org.

You can also sign up to receive our weekly newsletter and other updates here.